Senior Citizens

Senior citizens & vulnerable adult investors

Slick schemes, Shattered Dreams & Broken Hearts

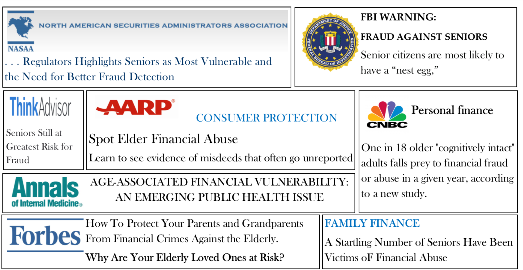

The financial industry is littered with slick schemes that result in broken dreams for seniors who take the bait. Stories of elderly seniors losing their life savings are far too abundant. Seniors are being targeted through the Internet, mail, phone, in-home visits, and ‘free meal seminars.” In addition to a free meal, the lure for many of these seminars is that “income” will be “guaranteed” and substantially higher than the returns someone on a fixed income can expect to get from certificates of deposit, money market investments or other traditional financial products. The advertisements often imply that there is an urgency to attend. Invitations include phrases such as “limited seating available” or “call now to reserve a seat.” And while the ads may stress that the seminars are “educational,” and “nothing will be sold at this workshop,” many of these seminars are intended to result in the attendees’ opening new accounts. Seniors seeking educational insights and information should be aware that the primary goal of these seminars is to obtain new customers and sell investment products. A survey by the North American Securities Administrators Association (NASAA) shows senior investment fraud accounts for nearly 50% of all complaints received by state securities regulators. That number is up from the 2005 survey, when 28% percent of fraud reports involved the elderly to large groups of seniors, says Bob

Webster, Director of Communications for NASSA.

Unethical financial advisors/brokers often use tactics to instill fear in seniors of running out of money and becoming a burden to their families. They inspire distrust in seniors of family members concerning their finances to keep seniors from disclosing the fraud. And they prey upon the loneliness and isolation, and availability of some retired or widowed seniors.

Questions about your securities fraud case, FINRA Arbitration or stockbroker misrepresentations or omissions? Speak with Mr. Schulz, a seasoned professional with over 43 years in the securities industry.

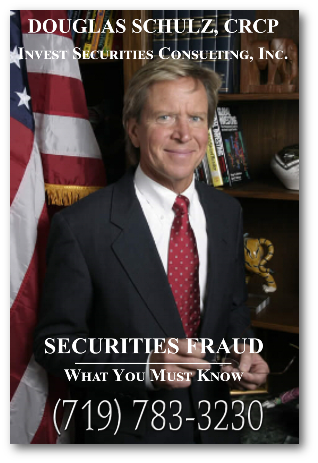

Red Flags Brokerage Speak

Senior financial Fraud “The Silent Epidemic"

New FINRA Rules Take Effect to Protect Seniors and Vulnerable Adults from Financial Exploitation

Monday, February 5, 2018

First Uniform, National Standards to Protect Senior Investors

WASHINGTON Two FINRA rule changes took effect today addressing the financial exploitation of seniors and vulnerable adults, putting in place the first uniform, national standards to protect senior investors. Firms are now required to make reasonable efforts to obtain the name of and contact information for a trusted contact person for a customer’s account. In addition, the rule permits FINRA member firms to place a temporary hold on a disbursement of funds or securities when there is a reasonable belief of financial exploitation, and to notify the trusted contact of the temporary hold.

“These important changes, developed in collaboration with our members, provide firms with tools to respond more quickly and effectively to protect seniors and vulnerable investors from financial exploitation,” said Robert L.D. Colby, FINRA’s Chief Legal Officer. “With the aging of the U.S. population, financial exploitation is a serious and growing problem, and protecting senior investors remains a top priority for FINRA.

The trusted contact person is intended to be a resource for firms in handling customer accounts,

protecting assets and responding to possible financial exploitation of any vulnerable investors. The new rule allowing firms to place a temporary hold provides them and their associated persons with a safe harbor from certain FINRA rules. This provision will allow firms to investigate the matter and reach out to the customer, the trusted contact and, as appropriate, law enforcement or adult protective services, before disbursing funds when there is a reasonable belief of financial exploitation. It is a critical measure because of the difficulty investors face in trying to recover funds that they have inadvertently sent to fraudsters and scam artists.

go to FINRAs Frequently Asked Questions Regarding FINRA Rules Relating to Financial Exploitation of Seniors

FINRA, “The protection of our senior investors, as well as baby boomers who are retired or approaching retirement is a top-priority.

Financial abuse of the elderly can occur in many forms, including theft, misrepresentations of risky, high-commission securities, and churning.

Click image below for FINRA s BrokerCheck

Former Financial Advisor and Securities Broker Admits Stealing More Than $1.2 Million from Client

June 2016

Deirdre M. Daly, United States Attorney for the District of Connecticut, today announced that ROBERT N. TRICARICO, 60, of Milford and formerly of Darien, waived his right to indictment and pleaded guilty yesterday in Hartford federal court to one count of wire fraud related to his misappropriation of more than $1.2 million from an elderly client.

Until April 2015, TRICARICO was a registered securities broker with the Financial Industry Regulatory Authority. He was formerly employed or associated with various financial firms, including RNT Wealth Management, Northstar Wealth Partners, LPL Financial, and Wells Fargo Advisors Financial Network.

According to court documents and statements made in court, from January 2010 to June 2013, TRICARICO acted as a financial advisor for an elderly and infirm victim who had substantial assets. TRICARICO misappropriated more than $1.1 million from the victim by writing numerous checks to himself or for his benefit without the victim’s authorization. TRICARICO also liquidated a coin collection belonging to the victim, and he misappropriated checks made payable to the victim. TRICARICO used the stolen funds to make personal expenditures.

In pleading guilty, TRICARICO also admitted that he defrauded two additional victims of $20,000 by falsely representing to them that he would use their investments for a business venture and guaranteed a rate of return. In fact, TRICARICO used the victims’ funds for his own personal use.

As part of his plea, TRICARICO has agreed to pay restitution in the amount of $1,220,763.90 to the victims of his crime.

Beware of misleading titles & Professional Designations

State securities regulators continue to see another disturbing trend of senior abuse. Increasingly, licensed securities professionals, insurance agents, and unregistered individuals are using impressive-sounding but sometimes highly misleading titles and professional designations. Many of these designations imply that whoever bears the title has a special expertise in addressing the financial needs of seniors.

While some of these designations reflect bona fide credentials in the field of advising seniors, many do not. These titles can serve as an easy way for an unscrupulous sales agent or adviser to gain a senior’s trust, which is the first step in a successful fraud. It is exceedingly difficult for prospective investors – particularly senior citizens – to determine whether a particular designation represents a meaningful credential by the agent or simply an empty marketing device. Use of such professional designations by anyone who does not actually possess special training or expertise is likely to deceive investors.

The use of a designation or a certification by salespersons, whether registered or not registered, may confer an impression with potential customers that the salesperson has special qualifications or specialized education in particular areas of finance, financial planning, estate planning, or investing.

State regulators are concerned that individuals are misusing “senior specialist” designations in aggressive marketing campaigns to provide a false sense of security to their customers. Such aggressive marketing results in unsuitable investments being sold to clients by salespersons who have little or no regard for the individual, specific needs of the senior client or understanding of the product which they are selling.